Volunteers are available on campus to file taxes for Maryland residents who make less than $67,000 a year.

Twenty-six students and other volunteers participate in the federal Volunteer Income Tax Assistance program, which started on Feb. 5 and will be available until April 5.

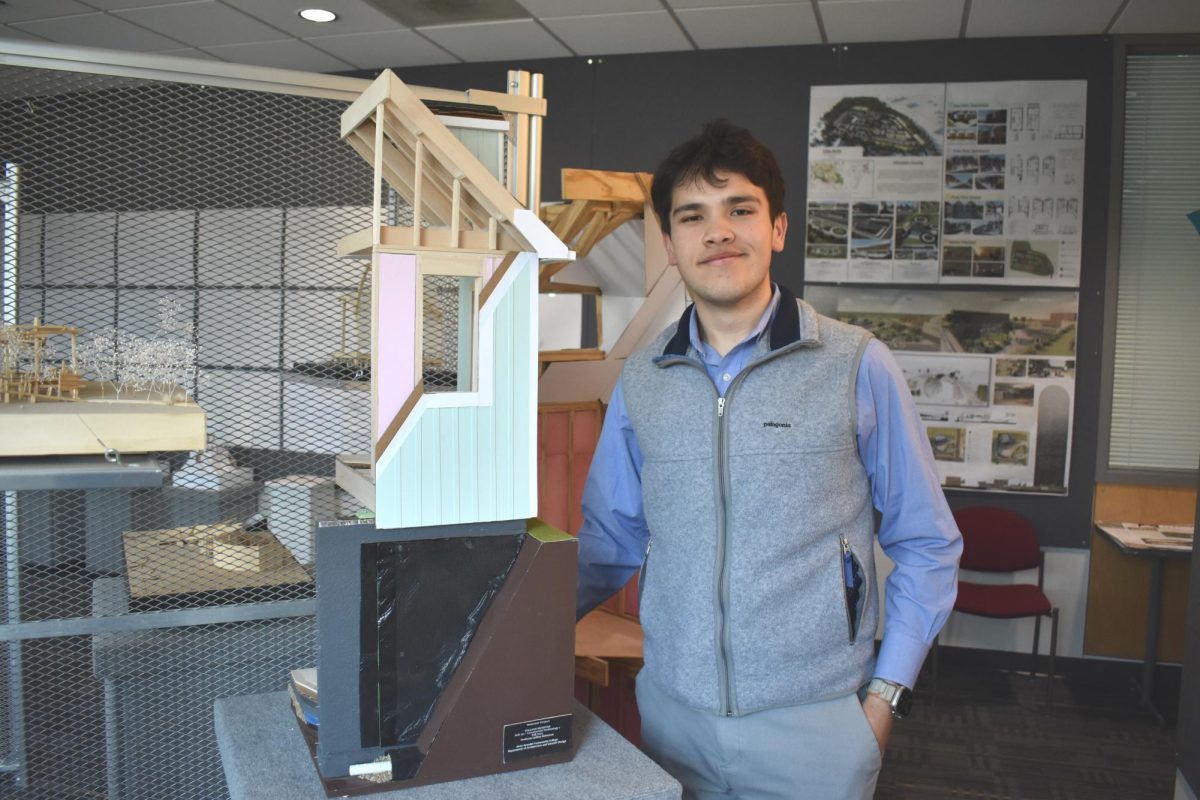

“It seemed very interesting to me, because you get to help out and learn about, like, tax returns,” Ahtziry Garcia, a second-year business administration student who is volunteering to prepare taxes, said. “And also, that’s something that I kind of want to do also in the future. So I thought it was a cool experience to do.”

Mark Loovis, a high school senior and returning volunteer, agreed, adding, “You can really apply that to a lot of things and then also, like, help people out because people need their taxes filed, and if you’re able to offer that skill. … So I think people can benefit from it.”

Accounting and personal finance professor Oksana Fisher is the program coordinator for the VITA program at AACC.

“People think that taxes are very complicated, and sometimes they are, but generally the scenarios we see here are, you know, straightforward.” Fisher said. “It just feels good to help people and just take one thing off their list, clear their taxes.”

According to Fisher, any Maryland resident can come to AACC by appointment for tax assistance. Appointments can be made through vita@aacc.edu.

Maria Ines Giraldo, a retired domestic violence victim advocate, said she learned about the program through the Internal Revenue Service website that AACC offers the VITA program and is “grateful.”

“The people that are giving this service, they are so nice,” Giraldo said. “You can see the charisma of the work that they are doing because they are happy.”

The program can serve 50 clients a week. Fisher said the volunteers filed 300 returns last year.